This post inaugurates an occasional series I’m calling, “Economic history in the present”. This series will look at vignettes from global economic history with an eye to current phenomena or particular events. Some will be more speculative, drawing on anthropology and philosophy; some will be more rigorous. Hopefully, both aspects of this approach will produce interesting juxtapositions that illuminate the present via the past. Without further ado, here is the opening salvo…

♠ ♣ ♥ ♦

While redistribution is a bit of dirty word today, it has been a key economic activity across human history. As resources move from the periphery of society to its centre through means more or less refined – from robbery and pillage to rents, taxes and tithes – the need arises for mechanisms to move some resources back from the centre to the periphery. Whether to pacify, reward or simply keep from starvation, the powerful have long given part of their take back to the powerless. Over the course of human history, the vehicles for redistribution have varied considerably: from the haphazard to the ritualized, from the simple to the elaborate.

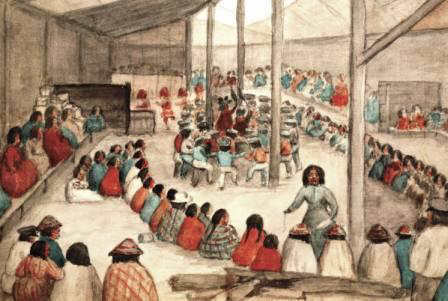

One oft-cited means of redistribution comes from the lands now occupied by British Columbia. The Pacific Northwest of North America has a rich tradition of the potlatch, a highly complex, formal redistributive process frequently drawn upon by anthropologists. In ceremonies lasting from several hours to several weeks, wealthy and powerful leaders of kinship groups gave away their wealth to guests from the surrounding area that included members of their own group and often entire rival groups. The more that someone gave away, or even destroyed, the more prestige they garnered and the wealthier they became in the eyes of others – despite the fact that a potlatch might leave them temporarily near penniless. Social status was conferred via giving rather than having.

The potlatch with its ironic twist on wealth should not, however, be mistaken for some kind of utopic ritual; the powerful could give away so much precisely because they had the power to obtain it in the first place. Redistribution is fundamentally about restoring a semblance of social balance; the potlatch gift is a counterpoint to the potential and actual exploitation and violence inherent in the prior process of distribution. It points to redistribution as pivotal in keeping social peace and ensuring continued social cohesion and survival.

In contemporary capitalist societies, redistribution happens largely via the tax system and subsequent public spending. This process employs the same motion of periphery to centre to periphery: the government first gathers wealth via taxes and then releases it back out in transfers and public spending. Although the scale, the dynamics and the institutional mechanisms of the potlatch and the tax and spend system vary wildly, a comparison of the two in key respects can shed some light on contemporary redistribution.

First, unlike the potlatch, which highlights the movement of resources out from the centre, the focus today is often on the movement into the centre. The tax system is a point of intense conflict: how much is paid in taxes is often more important than what is received in services. In the potlatch, although the focus is on the gift-giver and the display of power, a greater display of power is intimately tied to a greater amount of redistributed goods. Today, the focus on how much is paid in taxes reflects the power of the capitalist class to align the interests of society with its own. Tax rates are more important to those who have more to lose via redistribution, while the resulting spending is more important to those who have more to gain. Today’s displays of power are not more lavish hospitals, free universities or gleaming public housing projects; they are austerity programs, trade subsidies or the products of a subsidized military-industrial complex – the gains from which accrue back to the powerful.

A second difference is that today the redistributive institution is not the same one that wields economic power. During the potlatch, gift-giving was carried out by same powerful individuals who were the direct beneficiaries of an unequal distribution of goods from hunting, fishing, gathering and domestic production. Under capitalism, economic power is concentrated in the hands of the owners of capital; the majority of distribution occurs at the level of economic production. Government, in its role as a redistributive institution, is thus an appendage to the production system. It has numerous roles that aid the production system in other ways: from providing public goods that increase efficiency to upholding law and maintaining property relations all the way to expropriating by force. For the purposes of distribution and redistribution, however, government is concerned primarily with the latter.

Regardless of the form it takes, redistribution remains a corrective, one that is more or less important depending on the level of inequality and resulting potential for rebellion and discord that a society generates without it. The potlatch is, on the one hand, a romantic idea: gift-giving on a large scale with power proportional to how much one can give away. The redistribution is striking in its purity. Indeed, the potlatch took place in relatively egalitarian societies. As in many pre-capitalist social arrangements, the accumulation of respect and prestige was the driving force behind fundamental institutions, albeit one that also required an accumulation of wealth. The fact that goods were sometimes purposefully destroyed during potlatches bears this out.

On the other hand, the romanticism of the potlatch obscures the power structures and processes through which such redistribution comes to be necessary. While the potlatch gift loses some of its sheen under closer scrutiny, it also becomes a mirror in which we can see our own redistributive mechanisms reflected back. It is an illuminating counterpoint to the present-day distribution of goods, one premised on the potentially boundless accumulation of wealth, vast inequality and deeply obfuscation of both of these facts. What economic power hides behind the argument for the “burden” of tax in our society and the “gifts” of public services? What violence and exploitation make redistribution necessary?

Examining redistribution in historical perspective naturally opens up the debate to more fundamental questions about how power is distributed in society and the nature of our social arrangements. Looking at redistributive mechanisms more broadly means we have to look into how an economy distributes resources in the first place. If we see our tax policy as something more than a simple matter of rates and numbers but a reflection on how our economy and society are structured, then we can begin to think about how we can use it to alter those relations if they are not serving us well. A comprehensive debate about redistribution requires that we pay attention not only to tax rates or even what services taxes pay for, but to the entire redistributive process – what makes it necessary and the ends it serves. Looking at what goes to whom, we can get a better handle on the ends served by taxes and public spending and, beyond that, the ends served by our economy.