What would anti-austerity in Canada look like? There are really two types of questions here. There are those of analysis: what has Canada’s austerity looked like, what makes it distinctive and how does it appear in people’s everyday experience? The others are those of political strategy. These are questions that will have to wait for a social, political force ready to meaningfully take up the cause of anti-austerity. With none on the immediate horizon, I don’t intend to pontificate on what Syriza can teach Canada; best look first at what we can learn of our own situation.

When I interviewed him last week, Yanis Varousfakis, now the Finance Minister of Greece, laid out three very general planks of Syriza’s anti-austerity program. Of course, Greece is the unenviable victim of the cruelest austerity experiment in the North, but simplified to their most basic form the three planks articulated by Yanis have broad applicability. To paraphrase, they are

- dealing with debt;

- increasing social spending;

- generating public revenue.

Anti-austerity in such an utterly simplified form is the better starting point for relevance to the Canadian context than concrete political strategy. To start from the list above is very different from the question of the lessons that the political experiment that is Syriza offers Canada. Mine is a far more modest question – one that can be asked regardless of the (truthfully, sorry) state of any popular alternative to the neoliberal consensus.

The fundamental differences that anyone building an anti-austerity (program? movement? idea?) for Canada has to face is that Canada’s austerity has been on a relatively smaller scale. At the same time, Canada does not face the same constraints on its fiscal and monetary policy as countries like Greece or Spain and it has been the continued beneficiary of housing and commodity booms – one of which has only just recently ground to an abrupt halt.

Canada’s is best described as a creeping, slow-motion austerity. Stephen Gordon actually nicely diagnosed what this has looked like most recently (since about 2010): “…holding nominal spending constant means continued austerity: the costs of delivering a given set of public services increases more or less in line with GDP. The only way to reconcile rising costs with constant spending is to make cuts.” Austerity in Canada is, despite the small burst of stimulus in the immediate aftermath of the crisis, a background assumption not just for the Conservatives, but for all political forces, including those of social democracy.

There is no non-marginal political force in Canada that can at this time clearly articulate an anti-austerity vision. Nevertheless, taking Yanis’s three-part division, here is a broad outline of where to base a possible anti-austerity in Canadian garb.

(1) Dealing with debt

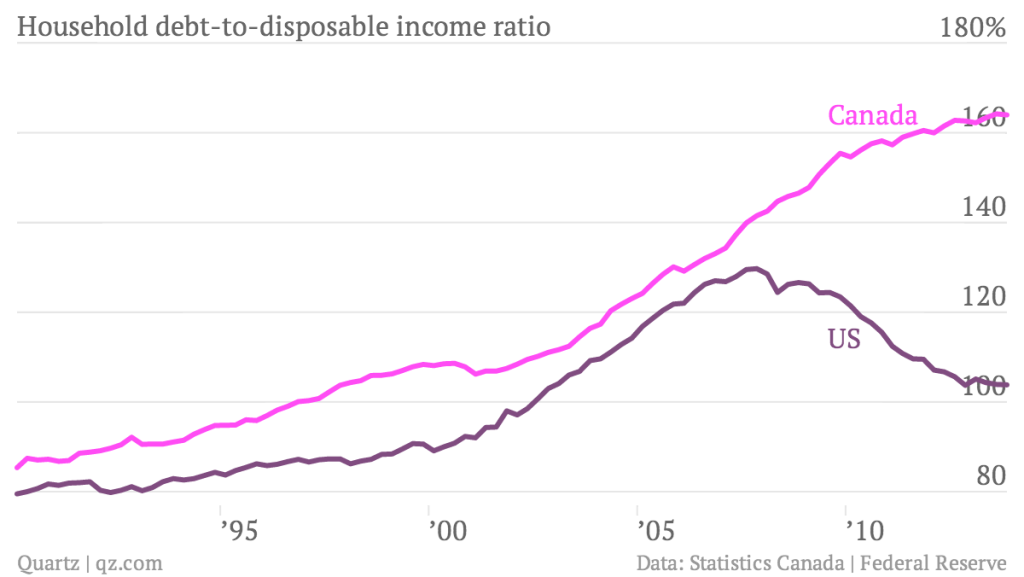

Canada’s public debt is neither as large as that of the crisis countries nor subject to the same (EU-imposed) political constraints. In spite of this, the climate of public debt panic is familiar and can be rapidly activated to discredit anti-austerian ideas. While such debt panic wrongly compares the government to a household and makes debt repayment a universal priority, households themselves are increasingly indebted. Indeed, but for a small hiccup, Canada’s household debt hasn’t slowed growing since the financial crisis.

Dealing with debt would mean taking on exploding household debt on the one hand and political primacy given to public debt repayment. (As many have said, this is about the morality and politics rather than the economics of debt.) More generally, it would mean challenging creditors. Capital has at once gone on an investment strike and is looking for other sources of return. This has meant significant funds flowing into consumption goods and services used by households, notably housing.

Capital gets a double boost: it derives profit from, for example, real estate investment as well as from the loans extended to households struggling to maintain standards of living. Here is a doorway to everyday experience, albeit one that must be used deftly as we outside the elites also experience gains here and there from asset appreciation that can be used to divide and conquer (for example, along generational lines).

(2) Increasing social spending

This doorway is also one that leads directly into the question of social spending, another means of furnishing rising living standards. Direct program spending by the federal and most provincial governments has decreased as a percentage of GDP since the 1980s and 90s. The health care system, rather than being expanded into pharmacare and dentistry must be defended from the constant threat of rollback, post-secondary tuition continues to rise and a real public childcare system remains largely in the realm of fantasy. Beyond this, public housing, which could in particular alleviate the debt pressures on households, has been moved off the table as has any sustained program of other public infrastructure investment. This is a wishlist, for sure, but one that until not too long ago was standard-issue social democracy – close enough to be a recognizable memory for older generations, exotic enough to capture the youngest ones.

(3) Generating public revenue

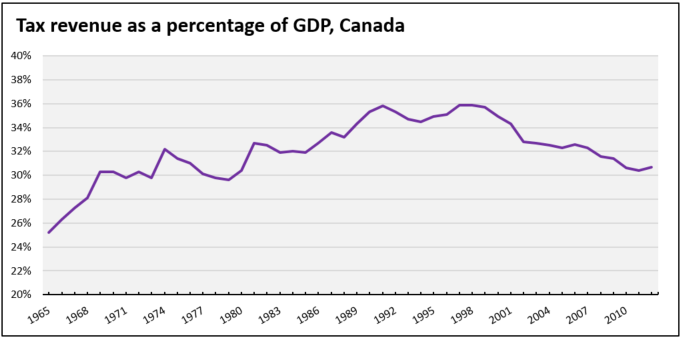

The next question, naturally, is “Who will pay?” It is the obverse of the question asked implicitly in the last two planks, “Who has paid so far?” We have all paid in form of foregone expansions to the welfare state, nevermind anything more transformative. Everyone will eventually need to pay for expanded, universal services that potentially decommodify now-private sectors of the economy but those who have disproportionately benefited from the grand heist of the last decades are the starting point for paying disproportionately more.

Wealth has congealed at the top to an astounding degree and the wealthy have used the power it confers to resist paying for much. In Greece, for example, this has taken the form of an outright tax strike; in Canada, meanwhile, tax cuts have become dogma across the political landscape: everything from the Conservatives’ recently implemented income-splitting to the NDP’s just-announced small business tax cut, the proceeds of which would largely benefit the very wealthy who use “small businesses” as tax shelters. The result is the “starve the beast” scenario: fewer revenues, fewer expenditures, more austerity, more debt.

Reversing our steady, lumbering austerity would mean looking at how wealth in Canada is generated, where it is stored and how it can be put to public use. Take, for example, the fact that the abruptly-ended commodity boom has left the province that was its main beneficiary scrounging under the public mattress even as corporate coffers are flush with cash. The exact shape of Canada’s elites and Canadian capital needs unpacking – a potentially popular exercise that could be put to good political use. Ultimately anti-austerity means taking on capital, as the Greek anti-austerians are tentatively starting to do.

One reply on “Three planks for a possible anti-austerity”

I like some segments of your argument and my reason for a response is not to criticize, but perhaps, provide information to revise your argument or just to present an opposing viewpoint. Due to certain exclusions of data in your essay, I think some of your argument is flawed and should be revised. Firstly, comparing Canada to Greece is like comparing Apples to Oranges. What you fail to describe in your argument is the real reason Greece is facing real issues as a result of debt. When you present the comparison, public and private debt, under only those parameters, Canada as a whole is not that different than Greece.

Here are the latest numbers (using OECD, IMF and national accounts data) comparing debt to GDP as a percentage: Greece: Public Debt 175%; Private Debt 123% for a total of 298%; Canada, on the other hand, is currently situated at 89% Public Debt; Private Debt 195% for a total of 284%. One has to ask the question, what’s really the difference in the debt problem as Greece and Canada appear to be almost identical? The reason they have the problem we in Canada are not facing (yet) is simply the exclusion of external debt as a percentage of GDP. When comparing the two countries, Greece has an external debt of 172% whereas Canada has an external debt component of 73% currently. It is the external debt sustainability that has become the issue in Greece that needs urgent redress.

In my view, your argument for anti-austerity would work is a falsity if current debt parameters were to remain the same, especially in the new global community as capital can flee quickly and contrary to popular viewpoint, money is not created out of thin air, meaning government money is free or requires no payback. One possible solution would be to deleverage debt during the times of austerity measures especially during good rates of economic growth which simply has not been the case worldwide as world debt continues to grow at an ever increasing rate. (It was precisely this deleveraging that had placed Alberta in the position they were able to obtain under Klein’s leadership.) In fact, using this data set mentioned above, you will find that world debt has increased 38% points since the last financial crisis in 2008. Considering the reasoning for world governments to allow this to happen is an entirely different debate.

In response to your argument concerning public debt, I somewhat agree with you insofar is that a problem currently exists. I wouldn’t agree that there is a credit hiatus or investment to only fuel consumerism, but a credit easing in all aspects of lending allowing ever more credit to become easily available to consumers and governments alike, in order to fuel unsustainable growth policies and expectations. If you consider that it’s estimated that up to 20% of households in Canada would be financially insolvent if the interest rates rose 2%, this would indicate that the credit was too easy to obtain in the first place or alternatively, it has allowed people and governments to spend beyond their financial capability or means. This is a very serious problem that has been exacerbated by increased spending by governments at all levels leading to ever higher taxes combined with increasing inflation leading to a devaluation in real terms of your dollar or spending capacity. The problem with the public perception of inflation is that they don’t understand is there are a number of major items that have increased in price, however, are not included in the calculations to determine the inflation rate, providing another falsity perpetuated by governments in order to look good.

In Ontario, there are many who can’t pay for the exponentially increased electricity costs, let alone increased taxes on nearly everything else. In Ontario, even the middle class is edging closer and closer to financial disaster. Regretfully, many have no choice but to finance these increases. Again, this is unsustainable as credit will eventually dry up, much like Greece’s current situation. One example is to explore issues relating to retired people, whether public or private with retirement income invested in the stock market. Those retired people are essentially getting paid for contributing nothing tangible to GDP numbers. In one scenario, if the interest rates were to increase to reasonable levels, would those retired people keep their money invested in the risky stock market if they could obtain a GIC return of even 6%. What would happen to the currently stock market if this was a possibility? The false valuations of stock prices would actually return where they are supposed to be. In the meantime, the existence of the various investment firms (London Life, Investor’s Group, etc), would find they would be laying off many from this relatively new employment developed in our so-called knowledge based economy. Hence, one of the reasons the interest rates are kept artificially low. If this were to happen, an argument could be made that society as a whole would likely benefit following the initial suffering with respect to debt. Many other examples could be provided to support why Canada is falling off the cliff caused by increased spending by members of the public and governments. You acknowledge that anti-austerity can be “rapidly activated to discredit anti-austerian ideas.”

My argument is that we should have a “debt panic” in Canada and we are rapidly approaching a situation similar to the Greeks by ever increasing spending if we were to stick to the current global financial paradigm. We have to remember that someday, that debt taken on for more spending has to be paid back eventually. No one in the private sector would lend money if there is no return. One might argue that the austerity program conducted by Liberal Government under Chretien and Paul Martin are likely the reason we are not in the same position as Greece, yet. What is necessary to understand is that the Liberal Governments at the time did so by passing the buck to Provinces, who passed the buck to Municipalities, then to the public that has caused the increase in public debt vs. external debt to finance the Canada at the Federal level. This may be one of the reasons the Greeks currently have less private debt than Canadians. A better solution would be to place the creation of money back in the hands of the Bank of Canada solely whereby money could be created and lent to provinces or municipal governments interest free. That doesn’t mean the money doesn’t have to be paid back, however, the subsequent payback would be relieved of the burden of compounding interest.

Secondly, I have some issues with your assertion that those at the top have not payed for much. Corporations and top income individuals actually contribute 68% of our total taxes collected. Seems insincere to state they haven’t paid their share. More spending at the government level has actually decreased the real income of all and caused an extreme accumulated amount of inflation that has eroded spending capacity via erosion of the value of our dollar since the 1960’s and continues to do so today. Government’s creation of jobs via increased regulation and enforcement have also had the same effect.

What is often forgotten in this type of argument is that we all operate in a global community now. I don’t necessary agree with the new globalization agenda as we tried it for most of the 19th century (ending with the start of WW1) and it didn’t work then as it will likely fail now, under the current paradigm. Capital will always flee to areas of the world whereby they will get the most return. This is really the reason that Alberta is experiencing the downturn of their economy as the globe is awash with cheap oil. Concurrently, the spreading lie that Alberta is in trouble is also a falsity, though their own government is insisting it’s true. The bigger question is: Why would they support and perpetuate this myth? Alberta’s current debt levels, mostly incurred due to increased government regulation and new spending, are still offset by the Heritage Fund. They currently have a debt level of $12.2 billion whereas they have a current surplus in the Heritage Fund (that was robbed of funds by the last few PC governments to increase spending) of approximately $17 billion. They hardly are scrounging under the mattress by my math. Especially when you consider the financial situation of most of the other provinces in Canada.

In conclusion, you state Greece, in their anti-austerity plan is embarking to take on capital. That isn’t their problem, the fact they took on so much capital, impossible for their society (under their current societal tax regime) to pay back, is the problem. The next obvious question is where they will obtain more capital? How will they pay this capital back? The EU, especially Germany, is rebuffing their plan to supply more capital unless they take measures to ensure the payback of capital loaned. China and Russia, have possibly offered to take up the slack and loan them more money, but at what cost? Considering that we are told Russia is broke (another falsity), how would they loan them any money? Having family members who lived through the socialist experience in the former USSR, this is not the route most people would choose for our society. It was catastrophic when compared to our current western lifestyle, even for the poorest among us. Unfortunately, following the anti-austerity methodology will lead us down that path, though I’m not entirely convinced that isn’t the direction our current politicians wish to guide us on purpose. Regretfully, due to our current comfort level in Canada, we seem to have forgotten the financial history of the failed societies in the world.

Yanis Varousfakis is a smart guy entertaining the idea that a bluff against the EU would work, however, as the world currently deals with economic and debt issues, he’s overplayed his hand. He is about to be slapped down. Either way you look at it, the Greeks have the same problem Canadians have with getting debt under control. We are so comfortable that none of us wishes to experience any pain or go without to actually get ahead financially as a society. This scenario applies to rich and poor alike, it’s not a class issue. With respect to Canada, our politicians should be telling us the truth rather than manufacture and distribute false narratives to become re-elected to the benefit of no particular sector of society except the elite. You are correct in one sense, the elite will benefit, whether in austerity or anti-austerity circumstances. They always do, I just believe with anti-austerity measures, there will only be less of them and most of the remainder will suffer to a greater degree. As for the Greeks, we will soon see the degree of their pain.

I hope you continue to explore this debate as it is a worthwhile endeavor that we should all be looking at more closely to find solutions. Thanks for the article. I did enjoy the writing.