Another title for this piece could be oil prices and politics. The last few weeks have been full of worries about the fate of Canada’s oil sector. Global oil prices are falling, pipelines are stalled and a few prominent tar sands investments have been canceled. All of these stories have been accompanied by cheering from the barricades representing those who want to Canada ween itself off its high-carbon fossil fuel industry as quickly as possible.

I, too, won’t be shedding any tears for the tar sands but it is good to keep things in perspective. Questioning the market for allocation of investment towards more fossil fuel development and more climate change, the lesson of the week is not to cheer too quickly for the market’s changing fortunes. Here’s a few charts that provide some of that perspective.

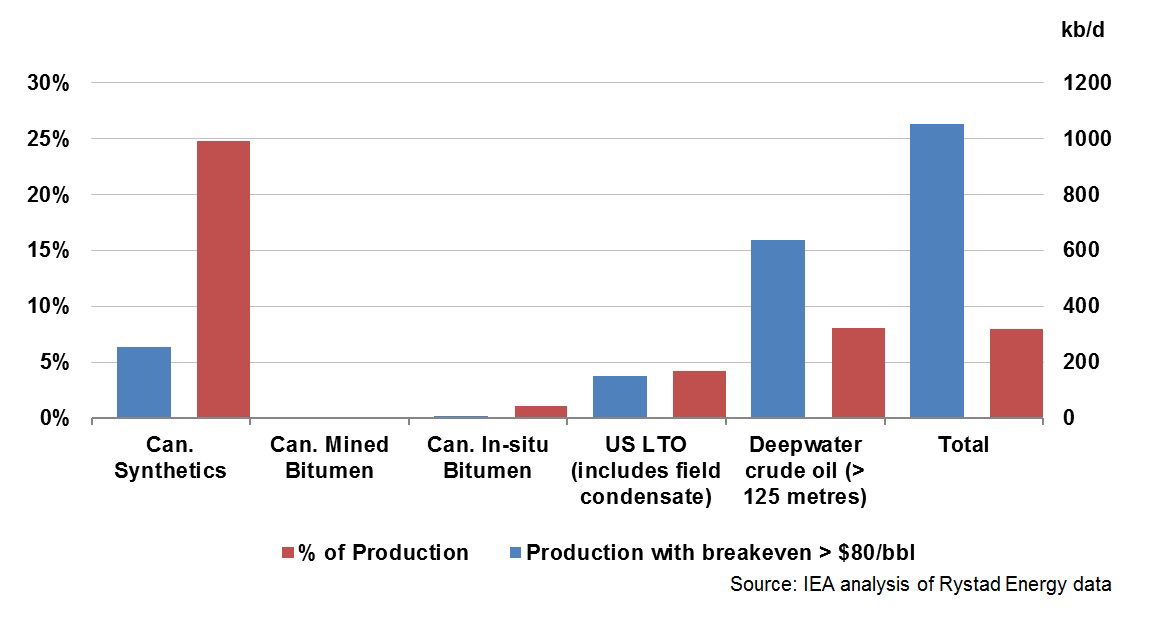

Yes, some parts of the tar sands are at risk of a loss of profitability from cheap (sub-$80 per barrel) oil, but they are largely confined to the upgraded products (synthetics):

However, oil futures in Canadian dollars have actually been quite stable, so the markets even now are not really predicting sub-$80 per barrel oil:

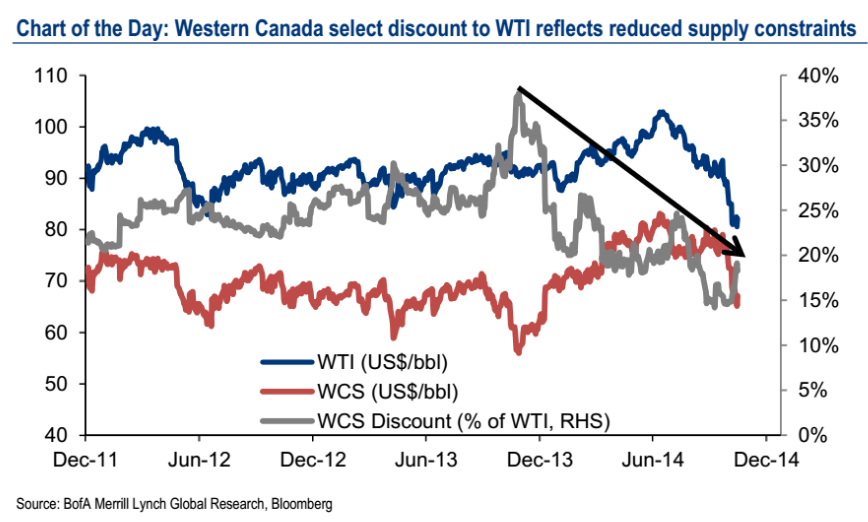

The assessment might strike some as too cheery but it is true that while there is a headline global oil price, in reality there are a large number of oil prices that differ by location, grade, and so on. In short, the price of tar sands oil has not fallen by as much as the headline price because of a depreciation of the Canadian dollar relative to the US dollar and a tightening of the gap between tar sands oil and the headline types of conventional crude.

The last graph illustrates this falling differential:

Fundamentally, however, the oil price prediction business is really like any prediction business: right until it’s wrong. Of course, estimations can be made but they’ve been proven wrong many a time. A specialist could list tens of factors, major and minor that will all have an impact on the future direction in the profitability of the tar sands: the factors listed above, transportation options and a host of other things there isn’t space to list and those I don’t know about. (Here, for example, is an analysis that low prices and more production in the short term may actually be good for both Saudi Arabia and the US; more generally, the centre of gravity in oil markets is shifting more towards the US as a major non-conventional producer.)

In short, we shouldn’t be surprised if the domestic oil industry manages to innovate its way out of this hiccup, at least to a large degree, whether through technology or regulation. It has already been doing the former successfully for the past couple of decades: technological innovation has made the tar sands economical on a large scale in the first place.

The latter, changes to regulation, are not hard to imagine given the strength of the fossil fuel lobby and the importance that the oil and gas industry has created for itself in the political imagination. The regulatory and subsidy regime could easily change further in favour of the oil industry in the face of consistent low prices. A fall in royalty rates (which are already often tied to revenues) and/or a boost to corporate subsidies (as other sectors have received when they were on the brink) could make some shelved projects viable again. There are other levers as well.

The tar sands industry is full of path dependencies — a kind of momentum that makes it harder to stop. This goes beyond just the demand effects — the greater amount of oil demanded at low prices (the dreaded Econ 101 argument) that will impact all oil producers.

Indeed, falling prices are another stab at the theory of “peak oil”. Carbon-fuelled capitalism, including its Alberta variant, has been doing very well (with intense public support, especially in the initial phases) at maintaining and expanding fossil fuel extraction and production. Falling oil prices reflect not the last gasps of the fossil fuel industry, but the dynamism that can carry entrenched interests along despite limits to specific technologies, like conventional oil extraction.

Capital is slick like oil. It’ll coagulate where there is least resistance. This is true of extraction projects, transportation and the rest of the business. For instance, given the lack of pipelines, oil transport has simply increased substantially by other means, including rail, which has been accompanied by lesser and greater tragedies.

We need a clear picture and movement for alternatives. Opposition to fossil fuel expansion is and should be infused with positive alternatives, like increased public investment in particular in public transit and green energy as a counterweight to the carbon-intensive tar sands. This means anti-austerity to complement a carbon austerity. Without a clear counterweight of this sort we may get stuck with an expanded domestic oil and gas sector despite lower oil prices, or falling domestic oil production and nothing to pick up the slack.

This isn’t anything new really — just a compendium to express some a general caution against putting too much hope in the vagaries of the market. The difficulty lies in laying the groundwork for new path dependencies that start with call for greater direct regulation of carbon emissions and can end anywhere, along with public control of key green sectors.

If anything is going to effectively challenge the oil industry in the long run it will be people, not markets. This is true not only globally, but in every local concentration of the oil industry like the tar sands — perhaps especially so here as conventional stocks dwindle and unconventional oil becomes even more important. If the case against climate change is to include a serious critique of markets, then this extends to when they are faring poorly (aka well).

2 replies on “Let’s not be too quick to cheer for the market as oil prices slump”

Just wondering, but what exactly is “Carbon Capitalism”? Capitalism based around Fossil Fuels? Is there such a thing a “Green Capitalism” or “Nuclear Capitalism”?

Sorry, that should have been “carbon-fuelled capitalism”, by which I just mean places where fossil fuel extraction is a significant sector; all capitalism now is literally carbon-fuelled to a huge degree in terms of where we get energy. Just a colourful descriptive, not a conceptual distinction. Maybe better to just have left “capitalism”!