Today the libertarian Montreal Economic Institute think tank released a short report claiming that Ontario’s $14 minimum wage is costing thousands of young workers their jobs and raising prices for everyone else. These overblown claims, based on skewed and cherry-picked data, came out—purely coincidentally to be sure—on the same day that Doug Ford’s Conservatives were set to enact Bill 47, the law that will cancel the planned increase in Ontario’s minimum wage to $15 on January 1, 2019 and reserve many other gains for Ontario workers such as two paid sick days.

The MEI study makes three main points, (1) that Ontario’s $14 minimum wage has caused 56,000 youth jobs to be lost so far, (2) that it has raised prices at restaurants by 5.6% and (3) that it is ineffective at fighting poverty. (Although it is irresponsible to call what MEI released a study; it is essentially a 2-page brief with an appendix mostly comprised of a very selective bibliography.)

Each is a claim is highly problematic, based either on cherry-picked data, a misreading of the research or both. Let’s take a look at each in turn.

First, the MEI claims that employment for 15- to 24-year olds in Ontario fell by 56,000 since the introduction of the $14 minimum wage. Looking at the data, however, it’s plain that there has been a big increase in youth employment volatility and it’s much less clear what the ultimate impact on youth employment itself has been. The MEI essentially cherry-picked a difference between the highest (November 2017) and one of the lowest (October 2018) volatile monthly points to get the largest possible estimate of jobs lost.

To see how volatile the data is, let’s pick a couple other month pairs. Between November 2017 and March 2018, the change in 15- to 24-year old employment is zero. That’s between the date Bill 148 was announced and after one quarter of it being in effect! Between July 2017 and July 2018 there was a gain of 22,400 jobs for 15- to 24-year olds. In fact, looking at these year-over-year changes in employment, the more stable average year-over-year change in youth employment in the ten months between January and October 2018 has in fact been a 16,900 job gain.[1]

Meanwhile, the employment rate for 15- to 64-year olds, which is much less volatile and comprises a much larger number of workers, is nearly identical today to November 2017, unchanged since Bill 148 was enacted. This represents a year-over-year gain of 82,800 jobs.

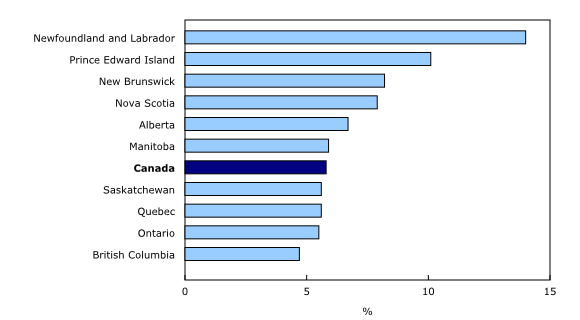

Looking more broadly at the first three quarters or nine months of 2018 so far, employment in Ontario has been up 1.7% on average year-over-year, higher than the rest of the country at 1.4% on average. In six of the nine months so far in 2018, Ontario’s unemployment rate was over 0.5% lower than in had been a year previous.

Not only has Ontario’s jobs performance kept up with or outpaced Canada-wide trends, it has been disproportionately strong in low-wage sectors—those where you would most expect to see negative effects from a higher minimum wage. September’s year-over-year employment growth in each of the three service sectors where low wage work is most common beat Canada-wide figures by around 0.5%. At the same time, earnings for low-wage workers have seen a big boost. Total wages in accommodation and food services, the most low-wage-heavy sector of the economy, were 14% higher in September than they were one year earlier, increasing at double the Canada-wide rate. Little sign of existing or impending labour market doom.

Next, the MEI cherry picks price data to fear-monger about out-of-control price increases. While Ontario’s restaurant prices did jump somewhat right after the minimum wage increase, overall inflation is in line with the rest of Canada. In fact, Ontario’s CPI is 2.2% higher than it was a year ago, exactly the same as Canadian CPI. In a meaningful, general sense, prices in Ontario are growing at the Canadian average. This is in line with most research, which finds very limited price effects from minimum wage increases.

The MEI is right, however, that restaurant prices did experience a bump. Between December 2017 and March 2018, they grew by 4.8% in Ontario; however, this has to be compared to overall price growth which was 2.1% over the same period—leaving a difference of 2.7%. Since then, however, restaurant prices have roughly kept pace with overall price growth and growth in restaurant prices across Canada (which Ontario has also tracked closely, with a very similar 2.6% shift upwards over the national average in early 2018). This relatively small, one-time bump in restaurant prices is not unexpected (and it is 27 cents on a $10 meal). In fact, it shows firms in industries with the very highest concentrations of minimum wage work finding avenues other than cutting jobs to absorb cost increases.

Finally, the MEI is wrong to claim that most studies show no connection between higher minimum wages and lower poverty rates. The latest research states the exact opposite, finding a clear link between higher minimum wages and lower poverty. A very recent “meta-analysis”, or study of studies, took 12 of the most credible new research papers on the topic, even including those from well-known academic opponents of raising the minimum wage and found that for every 10% increase in the minimum wage, the number of non-seniors living in poverty decreased by 2% to 5%. It also found significant increases in household incomes for the bottom half of households, largest among those in the bottom quarter. (For a good, non-technical explanation, see this piece in the Washington Post.)

Past research, today’s jobs numbers, even initial reports from the big banks confirm that a higher minimum wage does not spell doom, either for Ontario’s economy or for low-wage workers. In fact, it appears to have been the boost from the bottom up that was needed. While there is certainly space to study the effects of increasing Ontario’s minimum wage to $14 (and the still, as of writing, planned increase to $15 on January 1, 2019) in more detail, the MEI is only muddying the waters with its simplistic, skewed analysis.

[1] The impact on teen (15- to 19-year olds) employment has long been a key feature of minimum wage research, with some earlier research showing statistically significant impacts. Some more sophisticated and more recent studies from the US have overturned these results, finding no significant effects on employment from raising the minimum wage, even on teens. And even those still-significant estimates from recent Canadian research would find much smaller impacts (by a factor of more than two) than the crude calculations done by the MEI.