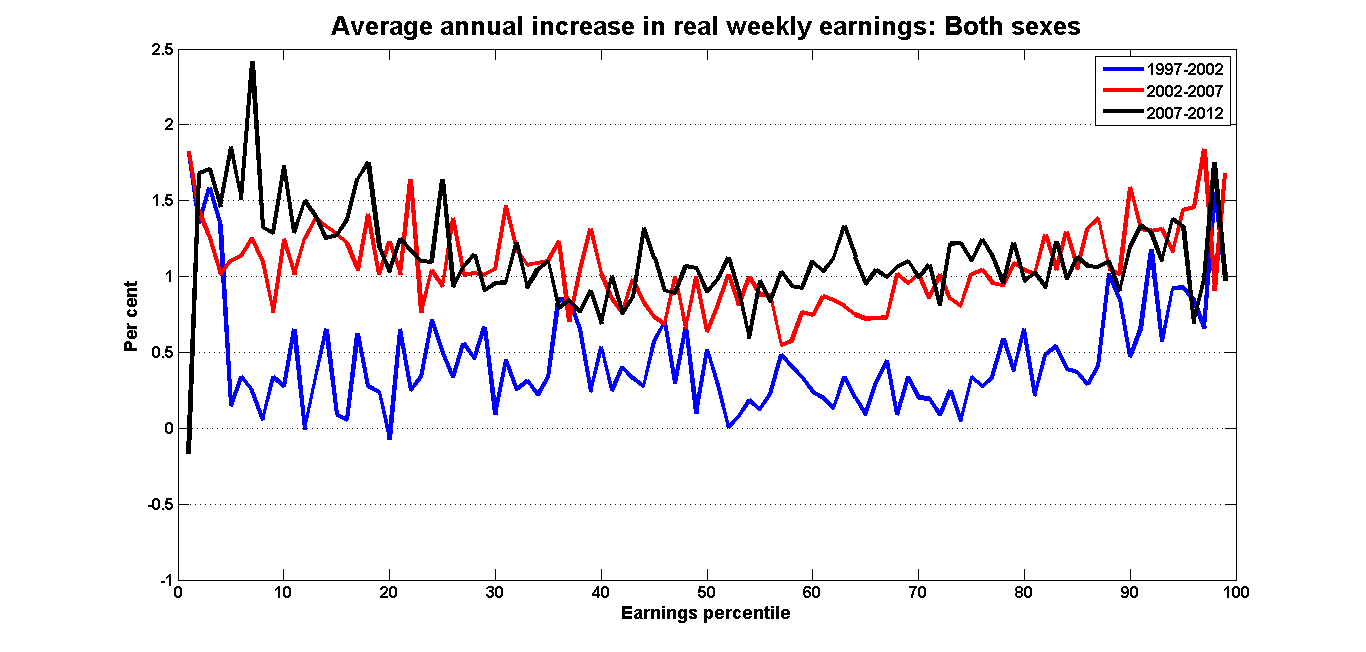

In a recent post titled, “What happened to the distribution of real earnings during the recession?”, Stephen Gordon presents a graphs that shows some significant growth in real (adjust for inflation) earnings in Canada between 2007 and 2012. In addition, plotting average annual growth rates in real earnings against the distribution of earnings, the graph has a U shape. That is, the growth rates of real earnings are higher for those at or near the bottom and those at or near the top of the earnings distribution, with a “hollowed-out” middle.

This graph, as well as several others presented by Gordon in this post and a previous article that show some sustained general growth in real earnings, goes against the received wisdom that real earnings have been stagnant, in Canada and across the world, for the past 30 or 40 years – especially so for low earners. What is behind the discrepancy between this new data and the long-standing trend? Gordon claims it is lower-than-expected inflation and, if not the active, then at least the passive policy of the Conservative government. I take issue with these claims.