Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Email | RSS | More

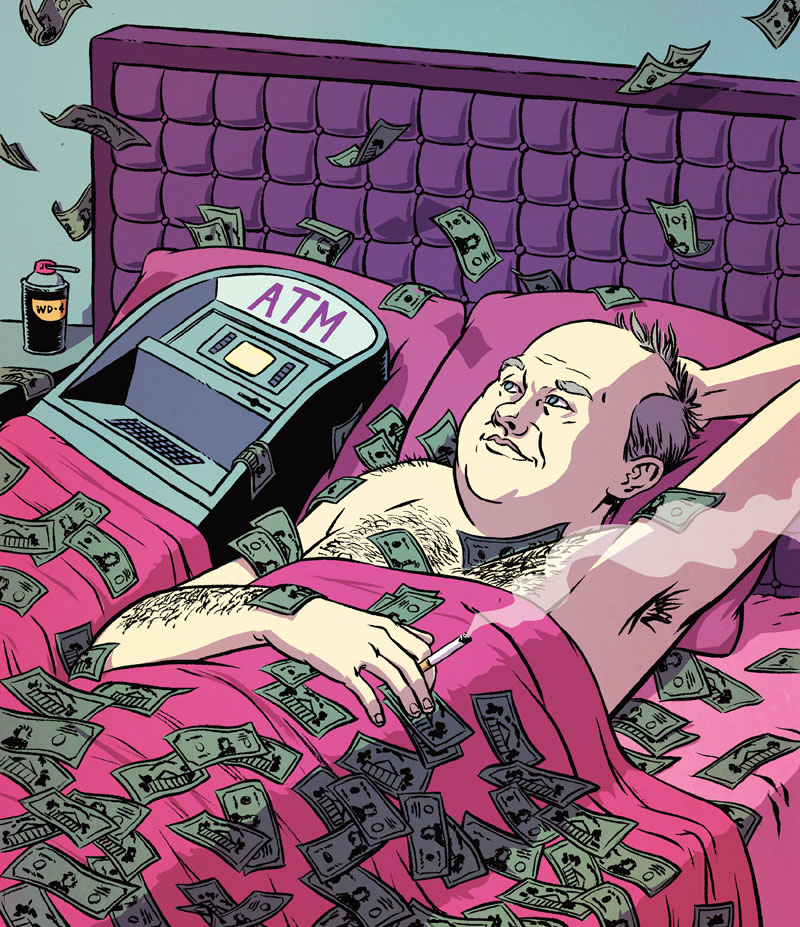

This week’s podcast is a bit more economics-focused than usual but gets at the heart of what’s going on in the global economy where interest rates are near, at, or even below zero, but where investment, growth, wages and employment continue to suffer. My one guest, who joins me for a feature-length interview, is J. W. Mason. J. W. teaches economics at John Jay College, City University of New York, blogs at The Slack Wire and is a fellow at the Roosevelt Institute. It’s for the Roosevelt Institute that he wrote a recent working paper, “Disgorge the Cash: The Disconnect between Corporate Borrowing and Investment”, that is the subject of our conversation. In short, the paper traces how, as a result of the shareholder revolution, firms today invest far less, even when borrowing conditions are better than ever, serving instead largely as ATMs for owners happily pumping out cash. This shift has big implications not only for economic policy, but for our understanding of today’s capitalism.

One reply on “JW Mason on business not investing, still disgorging the cash”

I really enjoyed this podcast but there’s a missing point. Here’s a fundamental reason for the over-financilization of the economy: Central banks around the world have become political animals.

To break the cycle of Stock buybacks and dividend fetish, interest rates would need go way up to match the average dividend. But If it were to happen, people would march in the streets yelling “Stimulus”. It’s a Catch-22…