This is the full transcript of my podcast interview with John Milios; it appeared earlier this week in Jacobin. John is a prominent figure within Syriza; he was the party’s chief economic advisor until earlier this year and is also a member of the party’s central committee, one of the 109 who signed a letter last week opposing the new memorandum.

Here, he discusses Greek Prime Minister Alexis Tsipras’s decision to hold the July 5 referendum, the anti-austerity course not taken by Syriza, and how the slogan “people over profits” can become a concrete reality in Greece.

Michal Rozworski: What is the situation one week after the memorandum was agreed to and two weeks after the referendum?

John Milios: When the referendum was proclaimed, we saw an election campaign that had class and social characteristics. There were two “Greeces” fighting each other. On one side, you had roughly the poor, wage-earners, the unemployed, and the small entrepreneurs, while on the other you had the capitalists, the managerial class, the higher ranks of the state, and so on agitating for Yes.

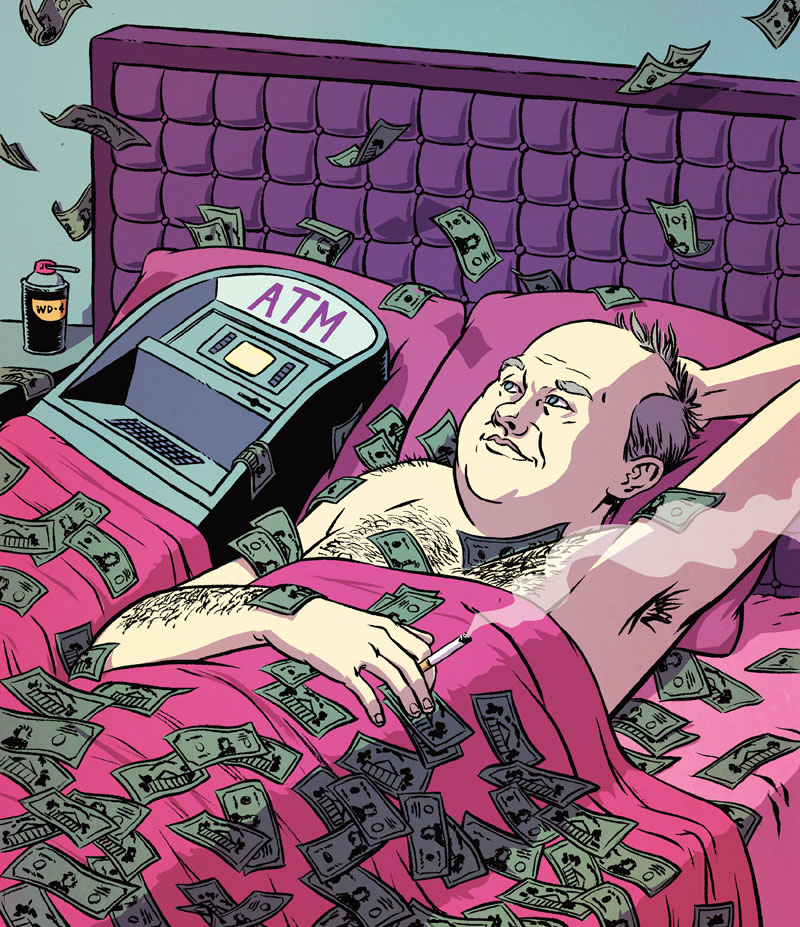

Ultimately, a broad coalition of the social majority saw the referendum as a chance to express their commitment not to continue with austerity and neoliberalism. All this happened in a situation of fear and terror arising due to the European Central Bank’s choice to not extend Emergency Liquidity Assistance (ELA) to the Greek banks. A lot of people saw this as a scare tactic and started withdrawing money. Ultimately, it led to a bank holiday.