There was an odd article last week on the explainer site Vox that argued Sweden doesn’t achieve its relative equality with very progressive, “soak the rich” taxation. While Matt Bruenig and Mike Konczal have already provided excellent, US-centred rebuttals to this argument, I thought this would be a good occasion to take a look at some comparative facts about Canadian inequality and overall redistribution.

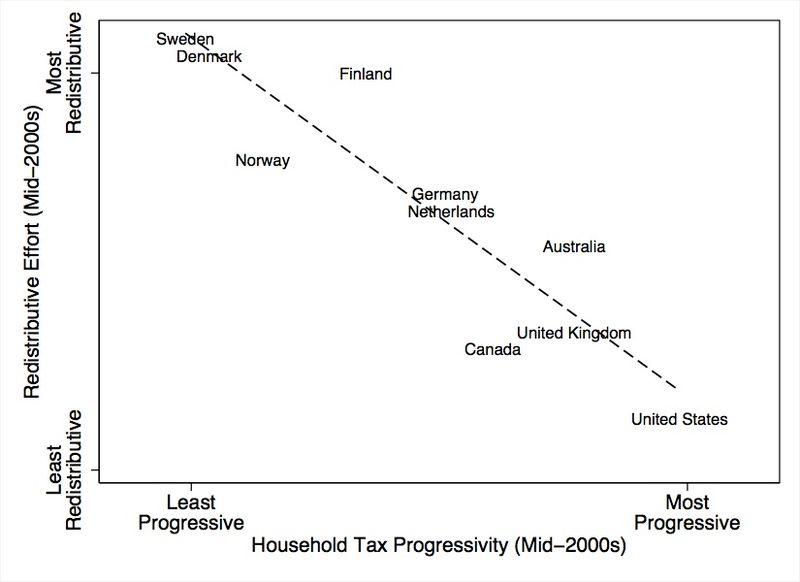

First, notice that on the chart in the original article, Canada is very close to the US, as being among the “least redistributive”. This goes against the national image of a kinder, gentler capitalism more akin to the various North European countries clustered around the middle and top of the chart.

The chart, however, is based on an odd measure of redistribution: the percentage of total income tax paid by the richest households (the Vox article doesn’t specify exactly, but it could be this OECD measure of tax revenue paid by the top 10%). As Bruenig and Konczal both point out, defining the degree of redistribution like this has many problems: for example, it can make a very unequal society with low and flat(ish) taxes appear to be much more redistributive than a fairly equal society with high and progressive taxes. In many ways, the Vox article is simply measuring the degree of inequality in multiple ways rather than relating it to tax progressivity.

In light of this, what does it mean that Canada is right down there clustered with the US as a country that supposedly taxes progressively but doesn’t redistribute? Is this something the chart nevertheless gets right? Is it that while Canada is often presented a kinder, gentler state that can be set alongside its Northern European counterparts (themselves no absolute paragons and eroding slowly), the gap between it and the US is really not that wide?

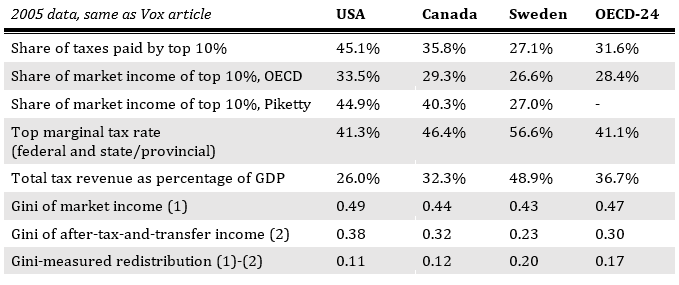

Here is how Canada compares to the US, Sweden and an OECD average for both the measures used in original Vox article alongside a few others:

Sadly, the picture presented by Vox is accurate to the extent that Canada appears on many accounts much closer to the US than Sweden, the stand-in for a more robust social democratic and redistributive state. Indeed, looking at the three top rows of the table, there is a clear link between the higher share of income going to the top (inequality) and the higher share of taxes paid for by those at the top (redistribution a la Vox authors Martin and Hertel-Fernandez). On both of these measures Canada is roughly in the middle between the US and Sweden and slightly above the OECD-24 average.

Looking lower, however, it is clear that Sweden still easily beats both the US and Canada in terms of tax rates on the highest earners. While Sweden “recycles” more of its income through the state (total tax revenue as percentage of GDP), it does not do it without soaking the rich in the process. Sweden does not lack of high taxes but, rather, it lacks more extreme inequality. Canada, more akin to the US, gets more of its total tax income from the rich only because the rich are richer – indeed despite taxing each individual rich person less. In fact, if we take into account an interesting recent study on how Canada’s wealthiest use private corporations to avoid paying tax, it turns out that our system is even less redistributive: the official data has Canada’s top 10% taking in 32.7% of after-tax income, they are actually getting 36.5% adjusting for the effect of tax-dodging via private corporations.

The final three lines of the table show a common way to measure redistribution and these confirm that Canada is no Sweden. The Gini is a (convenient and imperfect) way to measure inequality in a single number on a scale from 0 to 1, where 0 is perfect equality and 1 is perfect inequality. The difference between the Gini of market incomes and the Gini of after-tax-and-transfer incomes shows how much redistribution is decreasing inequality. While even Sweden has a high inequality of market incomes, it redistributes quite a lot; Canada, on the other hand, is right behind the US and its comparatively paltry level of redistribution.

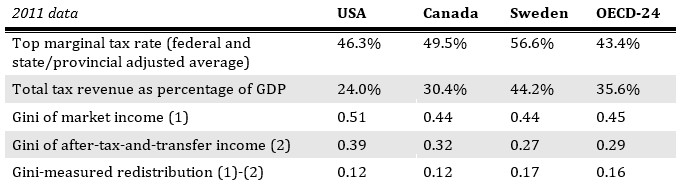

More recent data alters the picture slightly. All countries have felt the impact of the crisis via lower tax revenues – and one way they are trying to compensate is via raising top tax rates, especially given public anger at inequality. At the same time, Canada has edged closer to Sweden’s level of redistribution. Unfortunately, this is only because Sweden’s long-term, slow transformation of that has cut and privatized public benefits as elsewhere has shown up in the data. Canada is still no Sweden; it is Sweden that has become a bit more like Canada (or the US).

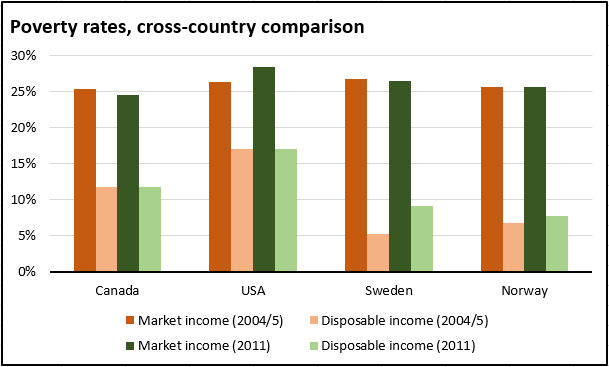

For another angle, it is possible to look at how redistribution affects poverty. To this end, here is a modified version of one of Matt Bruenig’s favourite charts with poverty levels based on market and disposable income for Canada, the US and two Nordic states, including resource-dependent Norway.

On this measure of poverty-fighting, Canada comes out a bit better than on the overall inequality-fighting comparison above – here, it is somewhere roughly between the US and the Nordics, with the effects of Sweden’s deteriorating welfare state also again visible for those at the bottom.

Steve Randy Waldman makes an interesting point also in response to the Vox article: what makes the difference to redistribution is not so much the relative difference of tax rates for rich and poor as the size of the transfer state. Of course, high tax rates help but they must be higher across the board to support a large transfer state – a state that ends up transferring large amounts of market income between residents. Soak the rich, yes, but at the same time, maintain a large pool of available public funds.

I would add that while transfers can take the form of cash or in-kind benefits like universal public services, there are many reasons to want the latter, including greater democratic control, freeing or keeping free from market logic specific areas of life and the mitigation of market failures. Universal in-kind transfers like public health, education or child care are not only large enough to require the kind of transfer state that Waldman wants but, at the same time, have greater transformative potential. In comparison, cash transfer are often suggested in conjunction with efforts to dismantle parts of the welfare state and/or advocated to be “targeted”, in other words, minimal.

As always, there are important political questions left out of this quick statistical and formal account: how the high transfer state was won and is being lost, what strategic role it played and could yet play for workers seeking greater economic democratization, what dangers it poses for the emancipation of different groups and what form it could take after decades of neoliberalism. One thing, however, is certain: Canada is no Sweden; it’ll have to soak the rich and recycle more income from everyone to move further from the US model.

PS – On a completely different note, for the masterwork of <blank> is the <blank> of <blank> thinkpieces, see the excellent Teju Cole’s “What It Is” just published in The Atlantic.