Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Android | Email | Google Podcasts | RSS | More

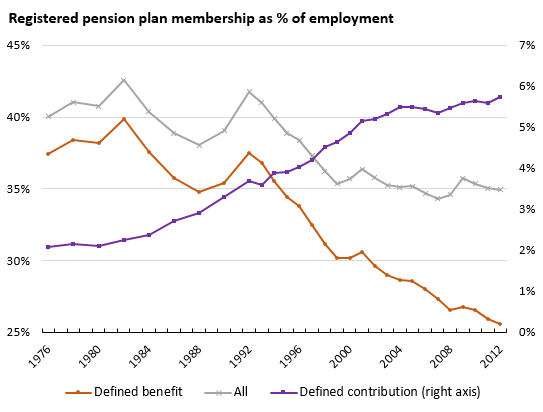

On today’s show, two sociologists talk about aspects of neoliberal restructuring. First, Nicole Aschoff, sociologist, author of The New Prophets of Capital and until very recently managing editor of Jacobin magazine speaks with me about the auto industry, Trump and why globalization shouldn’t be solely blamed for the destruction of good jobs even while it is nevertheless in crisis. Next, Mike McCarthy, assistant professor of sociology at Marquette University in Milwaukee, discusses his recent book Dismantling Solidarity: Capitalist Politics and American Pensions since the New Deal about how the pensions system has been transformed in ways that leave workers more vulnerable.

As always, remember to subscribe above to get new episodes as they appear, rate the show on iTunes and donate to help keep this good thing going. Thanks!