Trudeau met Trump on Monday but voiced no criticism. He stayed mum on Trump’s racist travel bans for Muslims and refugees—silent even about Canadian Muslims being arbitrarily denied entry at the US border. Many commentators in the media were quick to jump to Trudeau’s defense, excusing his total lack of spine with considerations of real economik: Canada’s trading relationship with the US is too valuable for us to go even mildly criticizing Trump.

Of course, Canada’s economy does rely heavily on the United States. But while over 75% of Canada’s exports go to the US, our trade relationship looks different than what many imagine it to be. And, in fact, the economy is much less of an excuse for Trudeau’s cowardice than it seems at first glance.

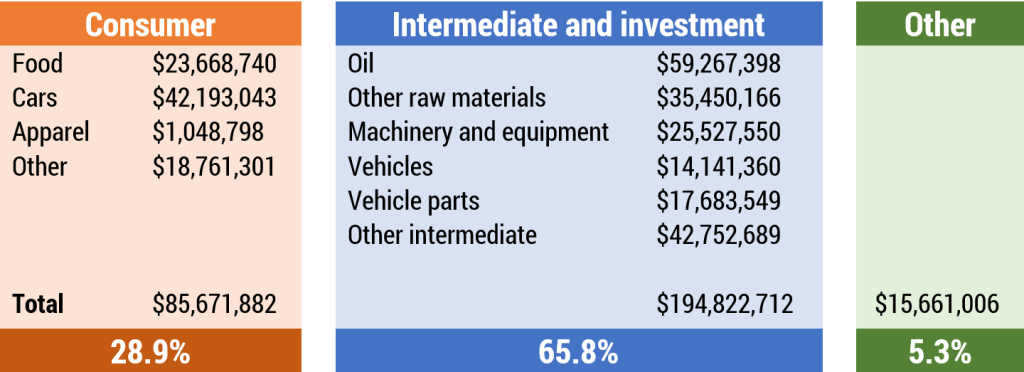

Here’s how Canada’s exports to the US break down: