Two very different provincial governments tabled their budgets this week. The freshly-elected BC Liberals and the seemingly election-ready Parti Quebecois both delivered what they termed “responsible” budgets. While the two governments identify with opposing ends of the political spectrum and face distinct political climates, these differences did not prevent their budgets from displaying some eerie similarities. Since these budgets tell the same stories, they are laying the ground for a common response.

Category: Canada

Yesterday’s federal budget was a non-event. Indeed, the no-surprises budget was itself no surprise: the Conservatives have long done their fiscal policy dirty work in omnibus bills and other dark corners scattered throughout the legislature, Crown corporations and federal agencies. This leaves the media circus of budget day a very stereotypically Canadian mix of polite and boring. Canada’s is a slow-motion austerity and the current budget is a continuation.

The endgame of the current rounds of cuts at Canada Post is some form of privatization. In the previous post, I argued that privatization proceeds differently depending on context. Many factors – I focused on whether a public service provider is exposed to competition and is profitable – can have an impact. The result of replacing public with private provision can be reached through a rapid sell-off, a slow attrition of services, or anything in between. Fortunately, the path to be taken by Canada Post is not yet drawn. Yet while privatization is not an inevitability, the window to effectively prevent it will not stay open for very long. Here are some thoughts on the privatization strategies possible at Canada Post and the anti-privatization strategies to fight them.

There is little doubt that Canada Post’s recently-announced plan to eliminate home delivery, raise prices and lay off thousands of workers is not aimed solely at streamlining operations, but is likely a prelude to future privatization of postal delivery in Canada. Canada Post is ripe for the picking: it is a profitable, socially-useful public enterprise with n updated, nation-wide infrastructure of retail outlets, other properties, vehicles and IT systems. One bad year in 2011, when the post office recorded a loss due in part to rotating strikes and a 2-week lockout, has been used to create an image of unsustainability and justify the current cost-savings plan.

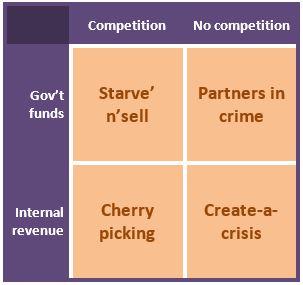

Any future privatization attempt can play out in a number of ways. While we typically think of privatization as a sell-off – the government transferring ownership of a public service provider into private hands – the exact nature of the transition between public and private service provision can take on a number of unique forms. Breaking a concept as broad, and at times nebulous, as privatization into more concrete and discrete strategies not only makes it easier to analyze particular episodes, but also aids in developing effective opposition.

I propose one way to differentiate between privatization strategies that is simple and universal. Four possible strategies emerge based on answers to two questions. First, are the majority of operating expenses of the public service to be privatized covered by internal revenue or government funds? Second, is the public service provider exposed to private competition before privatization? Looking at these two questions simultaneously produces the following grid of privatization strategies that can be used to assess what may lie in store for Canada Post and compare this to other privatizations, in particular those of postal services in other countries.

Several weeks ago, I published a series of blog posts on profitability and investment in Canada since the financial crisis of 2007-8. These were republished as a single long article on Socialist Project and given the title, “Canada’s Profitability and Stagnation Puzzle”. Since them, Sam Gindin has published a reply to my piece, “Puzzle or Misreading? Stagnation, Austerity and Left Politics”. Gindin challenges me on a number of fronts, most generally for misreading the current predicament in terms of a static formula that treats all capitalist crises ahistorically. This critique has ramifications for how Gindin sees not only my empirical account of present trends, but also my theoretical background and thoughts on strategies for resistance and alternatives.

Despite what appear to be many points of dispute, I think Gindin and I actually agree on a great many things, both in terms of the diagnosis of the current crisis and strategies for overcoming it. There are quibbles about statistics and wording, and I want to deal with a couple of these here, but I think we share much on broader theoretical and strategic matters. I want to primarily focus on the agreements behind our recent Socialist Project-facilitated interaction.

The past few days have not been great for public services in Canada. Canada Post will be phasing out home delivery of mail. Expansion of the Canada Pension Plan was scuttled at the finance ministers’ meeting. In the grand scheme of things, however, these are not extreme cutbacks. It’s not as if Canada Post is to be dismantled completely or our public pension fund to run completely dry. This government has long brought us death by a thousand paper cuts and those from the past days are just a continuation of the strategy.

There is a particular common thread that runs through all such small cutbacks. Corey Robin’s recent article in Jacobin, “Socialism: Converting Hysterical Misery into Ordinary Unhappiness”, helped greatly in seeing and naming it. Let us call it insourcing.

This kind of insourcing refers to taking a collective public service and making it into an individual responsibility. Perhaps James Moore recently summed up the insourcing philosophy best, “Certainly we want to make sure that kids go to school full bellied, but is that always the government’s job to be there to serve people their breakfast?” Serve your own breakfast, get your own mail, don’t wait too long to die.

Notes on pensions and risk

Canada’s finance ministers are meeting this weekend and a proposal to expand the CPP is at the top of the agenda. If implemented, this proposal would bolster an important public program at a time when public programs are under attack and the public sector as whole is shrinking. There are many good arguments in favour of strong public pensions, but I want to focus on one not often discussed: revitalized public programs are a counter to forces that aim to make us accustomed to taking on more and more (potentially disastrous) financial risk.

In yesterday’s post, I noted that austerity is not only a strategy to maintain business profitability, but also part of a broader agenda that can be neatly summed up by the phrase, “privatize gains, socialize losses”. From bailouts to public-private partnerships to the outright privatization of public services, the aim of much right-wing economic policy is to allow the private sector to capture economic gains, at the same time ensuring that society absorbs the costs of something going wrong. This removes financial risks from the private sector and distributes them throughout society.

Effecting such an agenda, however, requires more than just the appropriate policies – it also requires a fundamental change in attitudes towards risk. People have to become habituated to taking on ever-greater individual risks, especially in areas where risks were previously low. Pensions are a prime example of a policy area that can impact on attitudes toward risk.

This is the third and final post in what has become a three-part series on the puzzle of high profitability and low investment in the Canadian economy. In the first part, I looked at some data that shows the existence of the puzzle and explored a few of the factors that could be behind it. The follow-up post outlined broadly Keynesian and Marxian solutions aimed at raising investment: the former based on stimulating demand, the latter on eliminating overcapacity and increasing the relative profitability of productive capital. Here, I want to continue the thoughts that concluded the second part, namely that the Harper government’s preferred response to the puzzle has been neither demand stimulation nor industrial policy. Instead, it has been austerity – a strategy by no means accidental, but in fact designed to support the status quo of high profitability and low investment.

Austerity is not an isolated Canadian phenomenon nor is it a new one. The neoliberal era that began sometime in the 1970s has seen austerity in one form or another applied worldwide. Economic crises have especially provided governments with excuses to institute or continue austerity policies that would not have been difficult to institute otherwise. While Canada did not experience the latest economic crisis to the same extent as a number of other countries, it has seen a more moderate version of many of the same trends – such as slower growth and lower employment. The crisis was large enough to allow the Harper government to continue and deepen a tentative austerity regime. While Canada has not pursued austerity programs as spectacular as some, for example the UK or Spain, the Conservative government has, nevertheless, succeeded in substantially reducing the size of government, small cut by small cut. While Canadian austerity policies predate the crisis, the crisis has only helped to entrench them and further orient them towards propping up profitability.

Warning: A wonky, but thankfully short, post follows.

Yesterday, the Naked Capitalism blog reposted some recent research by OECD economist Eduardo Olaberria that looks at the effect of capital inflows on bubbles in assets, particularly housing. With so many other signs of a housing bubble forming in Canada, I decided to quickly see if the dangerous trends highlighted in this report are present in our economy today.

In my previous post, I outlined the disconnect between profitability and investment in Canada’s private sector. While businesses are doing well and profits have rebounded quickly after the global financial crisis of 2007, investment has continued its slow and steady 20-year decline. This decline is especially visible when investment is related directly to profits. Slightly more than 60% of gross profits are currently being re-invested, down by a third relative to just two decades ago. Such a gap between strong profitability and dismal investment does not correspond with standard accounts of how the economy functions. According to standard accounts, strong profitability should encourage investment, not depress it further. This theoretical relationship is not borne out in recent Canadian experience.

While the last post also examined a few factors that could have been at play in creating this odd state of affairs, here I want to move in the opposite direction and look at two competing pictures of how to revive low private-sector investment. The first picture comes from Keynes, the second from Marx. I am particularly indebted to Michael Roberts, who has written extensively on the crisis from a UK perspective and who used a similar framework in a recent article (on the adoption of the idea of a permanent slump by mainstream Keynesians).

The two pictures agree on a diagnosis of on-going stagnation – with low investment being just one feature. Indeed, the lack of sustained recovery across much of the developed world has led increasing numbers of mainstream economists to declare that the current slowdown is permanent. Paul Krugman, likely the most prominent Keynesian economist, recently wrote that we may have entered a “permanent slump.” Even the more hawkish Larry Summers has added his voice to the chorus, referring in a recent speech at the IMF to a period of “secular stagnation”. Many Marxist and other radical economists have, of course, been making the same point for years, citing a variety of structural changes and imbalances in the economy, particularly those that characterize the neoliberal period that began in the 1970s when the great post-war boom lost steam.

While their diagnosis may be similar, Keynesian and Marxian economists see the way out of the current long-term slump rather differently.